free cash flow yield private equity

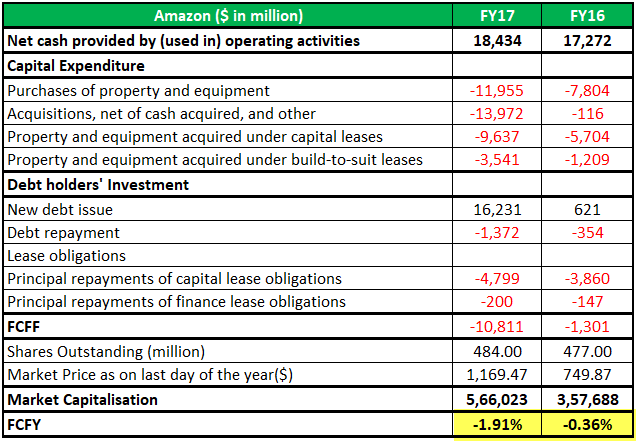

If the company has 200 in free cash flow last year the cash yield is 200 divided by 10000 or 20 per 1000 share. Historical Free Cash Flow Yield Data.

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Ad For Private Companies Who Want Equity Plans Done Right.

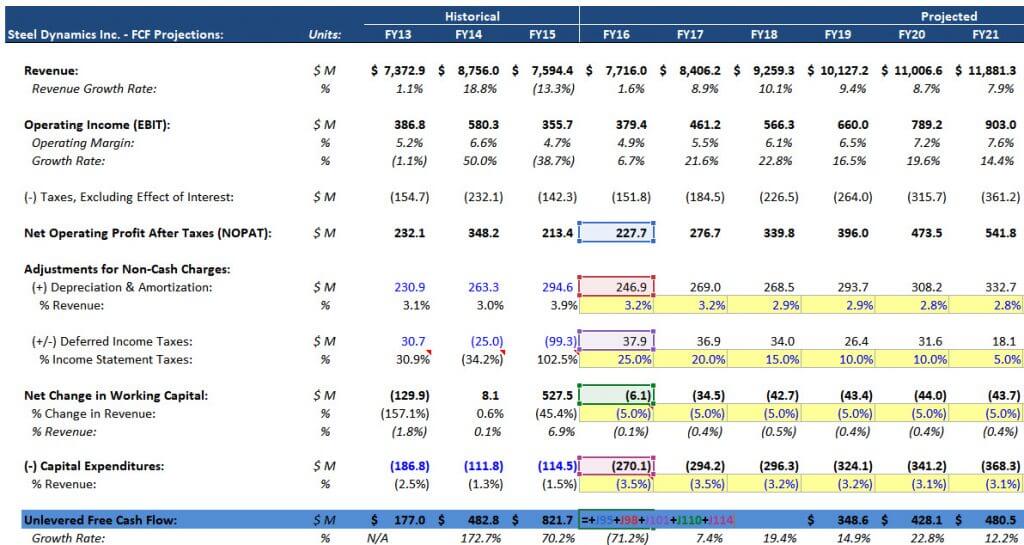

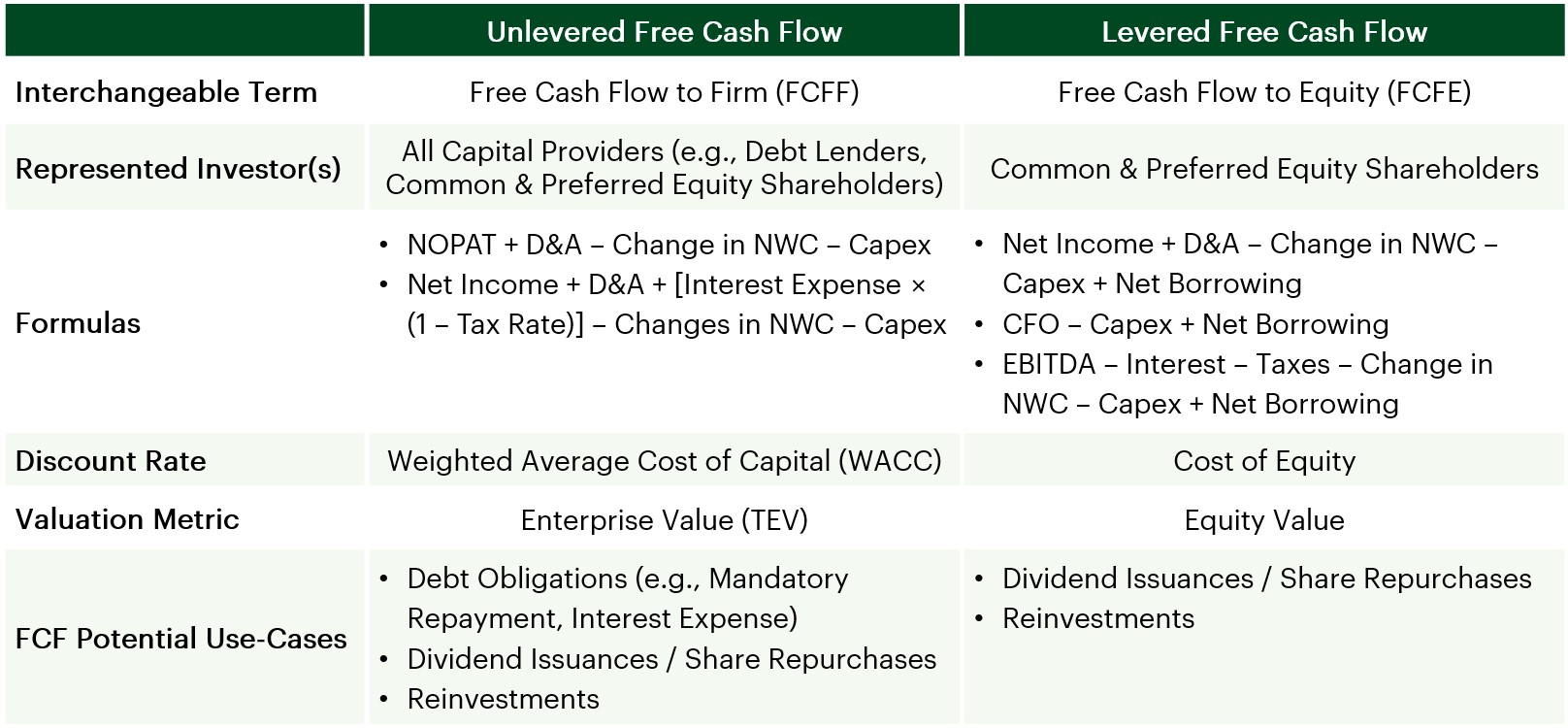

. Full Contact Details AUM Email and More. Discounting free cash flows to firm FCFF at the weighted average cost of capital WACC yields the enterprise value. The firms net debt and the value of other claims are then subtracted from.

Ad More than 40 years of specialized investment experience in alternative assets. More than 40 years of experience specializing in alternative asset investing. Dont Wait Until November To Help Solve The Energy Crisis.

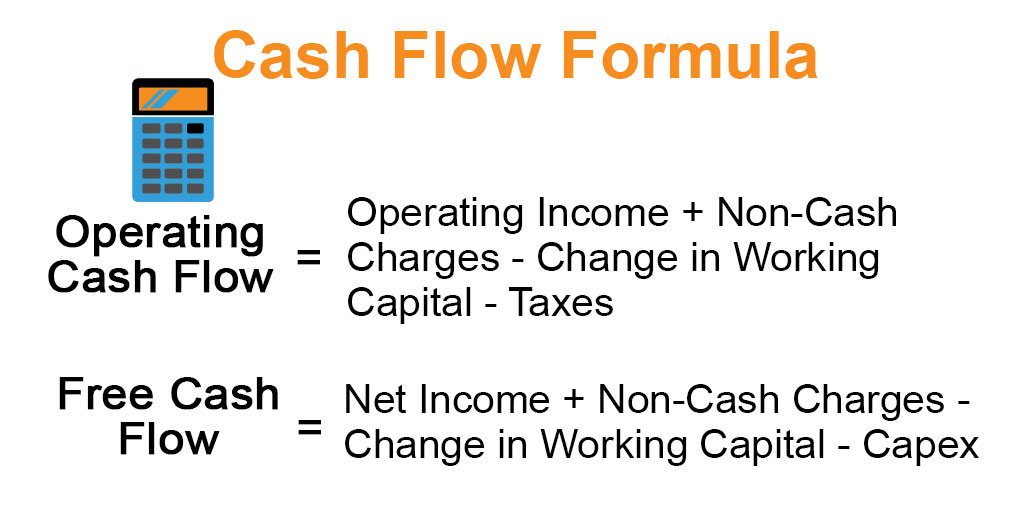

Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. Cash flows refer to the cash generated in the business during a specific time period after meeting all business obligations. Equity Metals Corp EQMEF.

Ad Search 4400 Hedge Funds in Excel. 26 May 2018. In that example your Cash Yield would be 10.

The Formula for Free Cash Flow Yield is. Since FCFE is intended to reflect the cash flows that go only to equity holders there is no need to add back. Strive Seeks to Liberate American Energy.

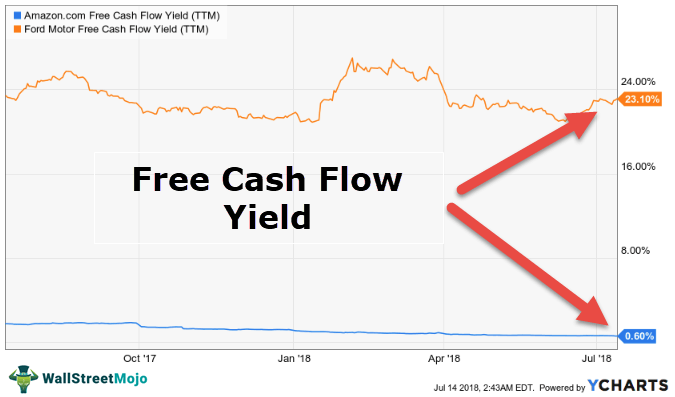

Ad See how Invesco QQQ ETF can fit into your portfolio. Thats 2 the same as the bond. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share.

Showing page 1 of 45. Suppose that you bought a property and your net cash flow was 5000 and the cash invested in your property was 50000. Free Cash Flow Yieldfrac Free Cash Flow per Share Market Price per Share F ree C ash F low Y ield M arket P rice.

In depth view into Equity Metals Free Cash Flow Yield including historical data from 2010 charts and stats. Heres the fun part. Companies with Free cash flow yield more than 7.

FCFE Net Income DA Change in NWC CapEx Net Borrowing. Ad For Private Companies Who Want Equity Plans Done Right. This cash flow is often referred to as free cash flow indicating that.

Cash flow is vital because if a business runs out of cash it may go bust even if it is making a decent profit. The free cash flow yield is an overall return evaluation ratio of a stock which standardizes the free cash flow per share a company is expected to earn against its market. Equity free cash-flow is the cash generated each year.

Free Cash Flow Yield Explained

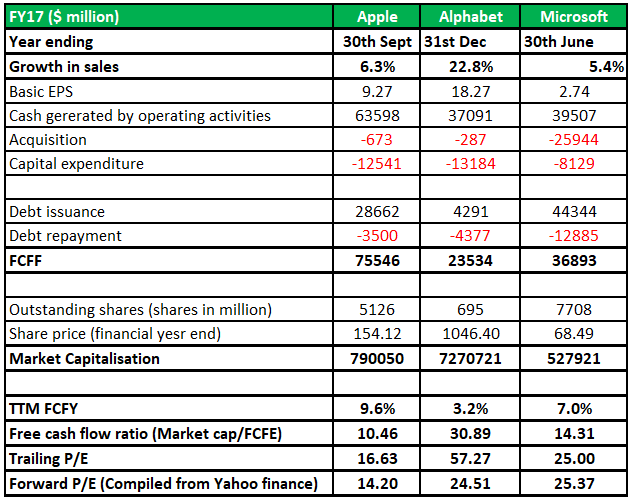

Free Cash Flow To Equity Fcfe Formula And Calculator Excel Template

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Explained

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Free Cash Flow Yield Definition How To Calculate Importance

Free Cash Flow Yield Formula Top Example Fcfy Calculation

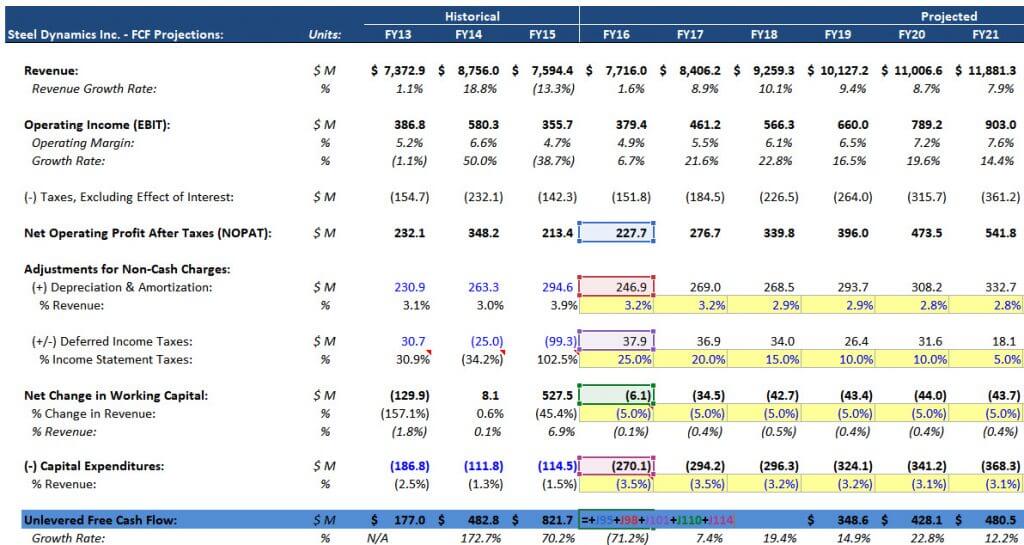

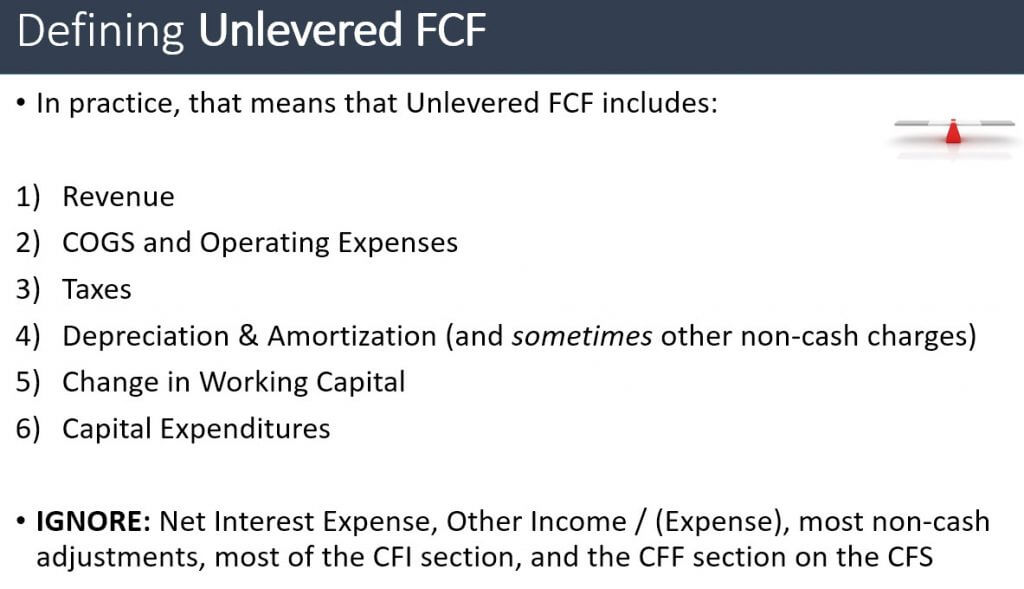

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Explained

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow And Enterprise Value Reit Institute

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

What Is Free Cash Flow Calculation Formula Example

Free Cash Flow To Equity Fcfe Formula And Calculator Excel Template

:max_bytes(150000):strip_icc()/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Cash Flow Formula How To Calculate Cash Flow With Examples

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template